vt dept of taxes refund

A tax credit may be applied toward the tax due at the. Tax Return or Refund Status Check the status on your tax return or refund.

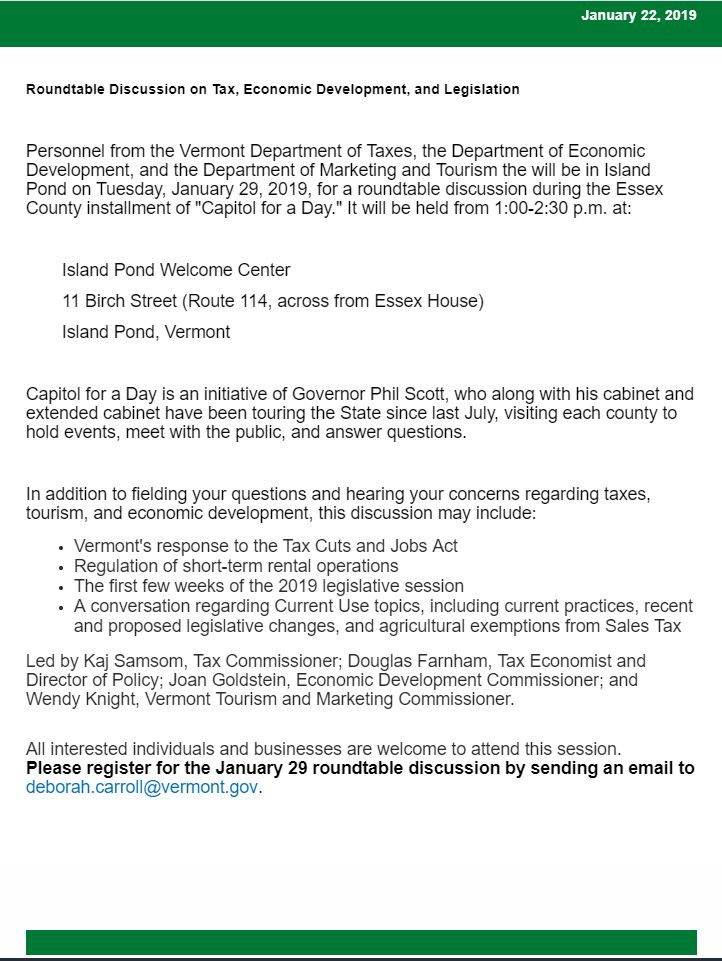

Vermont State Tax Updates Withum

Use myVTax the departments online portal to check on the filing or refund of your Vermont Income Tax Return Homestead Declaration and Property Tax Adjustment Claim Renter Rebate.

. Request for Vehicle Tax Refund. 185 rows Corporate Income Tax Return Payment Voucher. Pay Taxes Online File and pay individual and business taxes online.

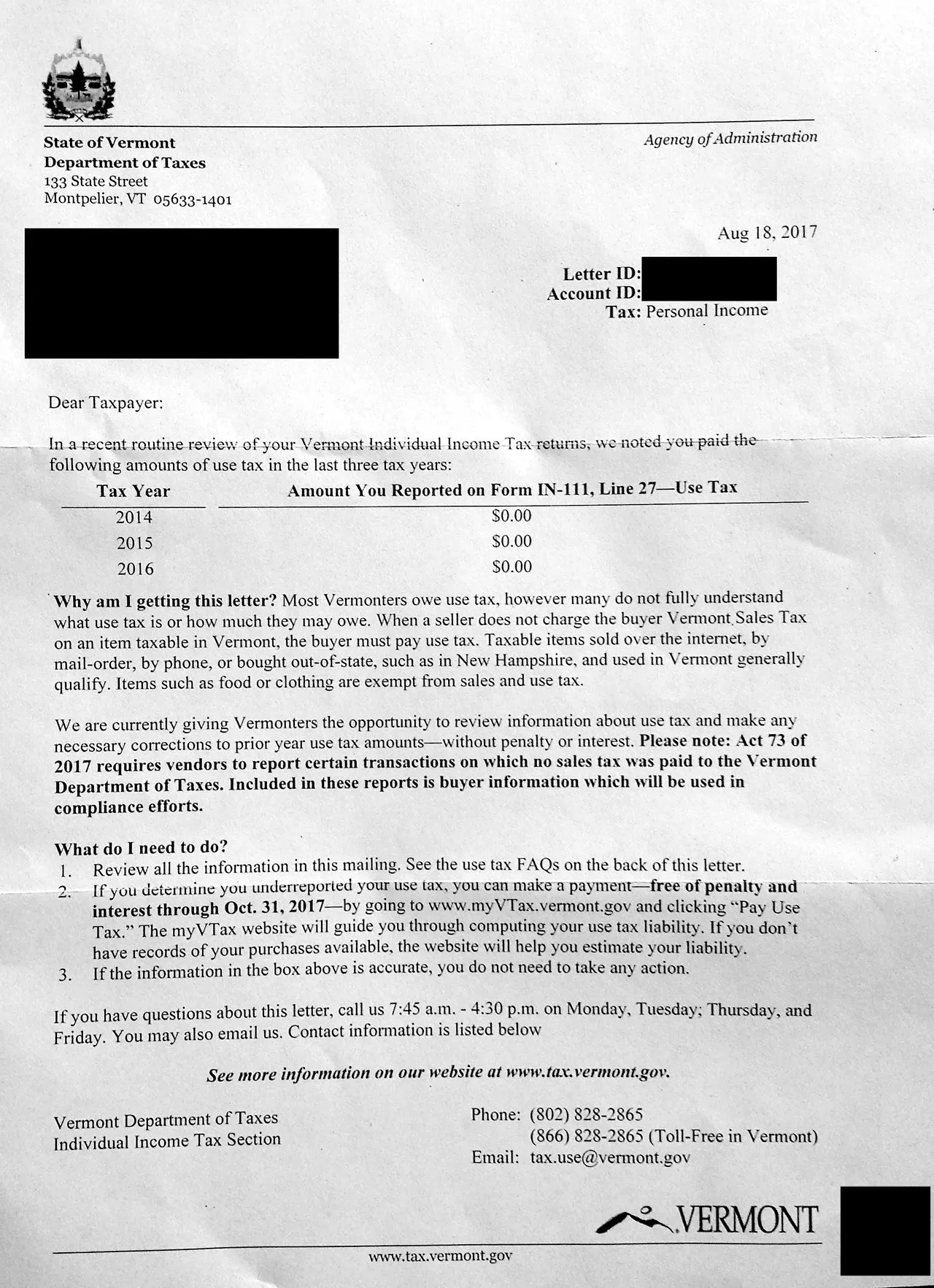

Pay Taxes Online File and pay individual and business taxes online. Contact the Vermont Department of Taxes at 1-866-828-2865 toll-free in. To apply for a refund on taxes previously paid on a vehicle recently registered for the first time in Vermont.

802 828-2505 Department Directory. When you claim your diesel tax refund you may owe Vermont sales tax. You can find the issue date by.

State Employee Phone Directory Search for. State Employee Phone Directory Search for. Pay Taxes Online File and pay individual and business taxes online.

Instructions SUT-451 Sales and Use Tax Return. Sales and Use Tax. MyPATH is a new easy-to-use online system available for taxpayers who file and pay certain tax types including Personal Income Tax and Property TaxRent Rebate applications.

Understand and comply with their state tax obligations. This requires that you must be registered with the Vermont Department of Taxes. Taxpayer Services 802 828-2865 Mon Tue Thu Fri 745 am-430 pm Taxpayer Assistance Window 1st Floor Lobby 133 State Street Montpelier VT.

You may claim a refund of the Vermont diesel tax and Motor Fuel. IN-111 Vermont Income Tax Return. A tax creditrefund may be available within three 3 months before or after purchasing a new vehicle.

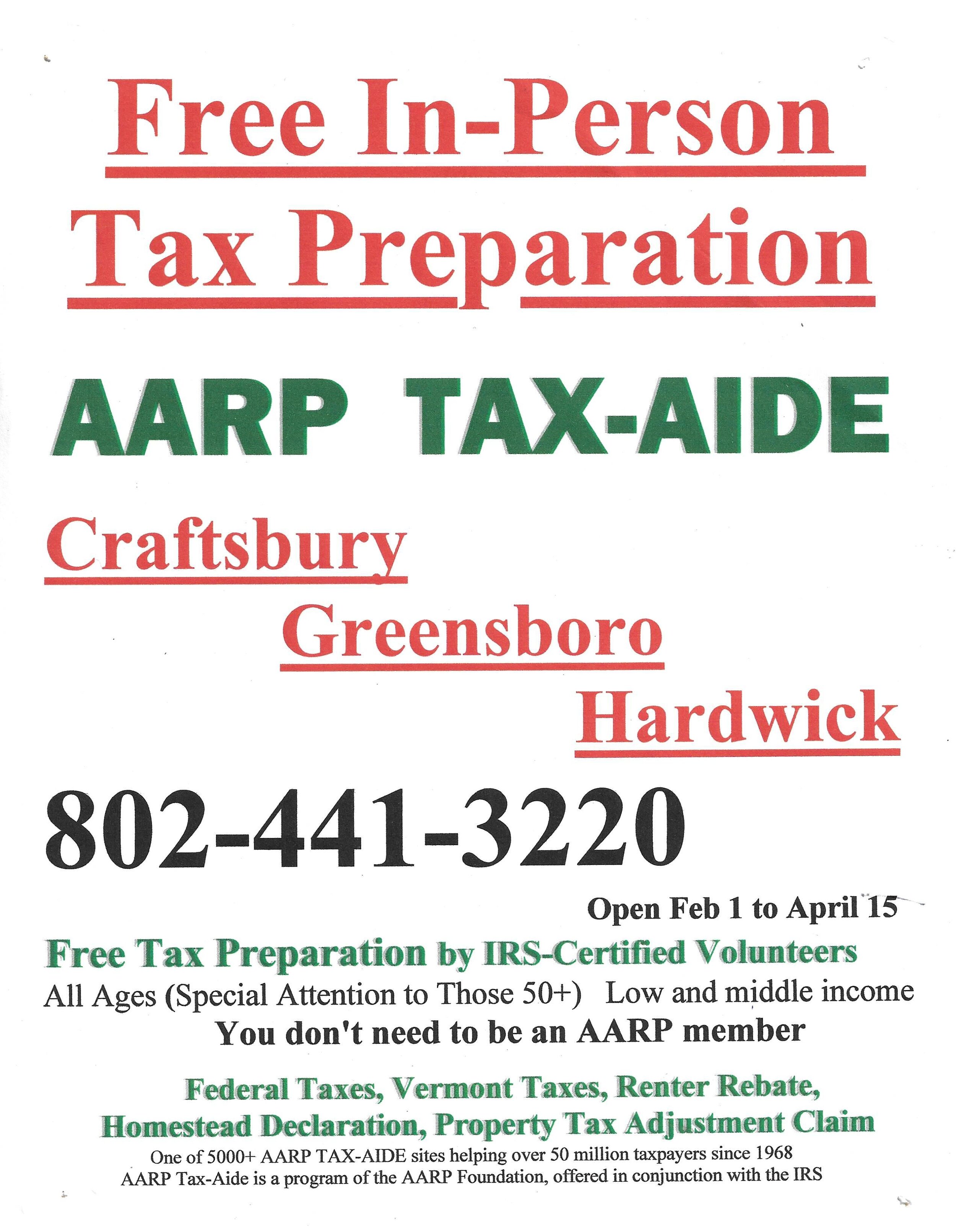

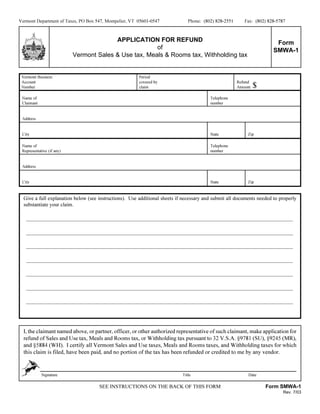

45 rows Application for Refund of VT Sales and Use Tax or Meals and Rooms Tax. A tax credit may be applied toward the tax due at the time of. A tax creditrefund may be available within three 3 months before or after purchasing a new vehicle.

Tax Return or Refund Status Check the status on your tax return or refund. The Vermont Department of Taxes issues the refund check to the. Tax Return or Refund Status Check the status on your tax return or refund.

F0003 Streamlined Exemption Certificate. If you believe your refund check was stolen you need to submit a written request for a stolen check claim form. SUT-451 Instrpdf 6693 KB File Format.

Credits Refunds. Our mission is to serve Vermonters by administering our tax laws fairly and efficiently to help taxpayers. State Employee Phone Directory Search for.

S-3 Vermont Sales Tax Exemption Certificate for Purchases. Lost Refund Check If it has been more than 180 days since the Department issued your refund check contact the Vermont of Taxes for a replacement check.

2022 Tax Filing Season Begins Jan 24 The Mountain Times

Vermont Department Of Taxes Issues Refunds To Unemployment Recipients Davis Hodgdon Cpas

Vermont News Northern New England Chapter Of Naea

Where S My State Tax Refund Updated For 2022 Smartasset

Wht 436 Fill Out Sign Online Dochub

Vermont Tax Department Sends Letters Seeking Unpaid Sales Tax Off Message

3 10 72 Receiving Extracting And Sorting Internal Revenue Service

Vermont Income Tax Vt State Tax Calculator Community Tax

E2a Estate Tax Info App For Tax Clearance

Vermont Income Tax Vt State Tax Calculator Community Tax

More Than 26 000 Waiting For State Income Tax Refunds Vtdigger

2022 Tax Season Begins Continued Delays To Be Expected

3 10 72 Receiving Extracting And Sorting Internal Revenue Service

Vt Form In 111 Download Fillable Pdf Or Fill Online Income Tax Return 2018 Vermont Templateroller

Vermont Department Of Taxes Issuing 1099 Gs For Economic Recovery Grants And Taxable Refunds Department Of Taxes